Leawood Ks Property Tax Rate . Property taxes are going up. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. The state’s average effective property tax rate (annual. Assessed value and estimated actual value of taxable property last ten fiscal years. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. This is the same tax rate included in 2022’s budget, which the city intends. According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. 95 property tax rates (per $1,000 of.

from kansaspolicy.org

Assessed value and estimated actual value of taxable property last ten fiscal years. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. 95 property tax rates (per $1,000 of. The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. The state’s average effective property tax rate (annual. The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. Property taxes are going up. According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. This is the same tax rate included in 2022’s budget, which the city intends.

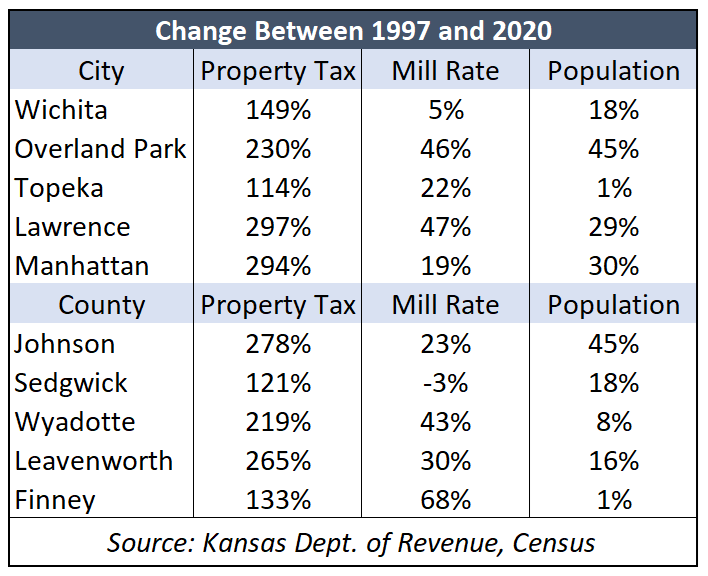

Kansas has some of the nation’s highest property tax rates Kansas

Leawood Ks Property Tax Rate The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. The state’s average effective property tax rate (annual. The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. Assessed value and estimated actual value of taxable property last ten fiscal years. 95 property tax rates (per $1,000 of. This is the same tax rate included in 2022’s budget, which the city intends. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. Property taxes are going up.

From www.pinterest.com

3113 W. 118th Street Leawood, KS 66211 • Hallbrook • 1,395,000 Leawood Ks Property Tax Rate Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. Property taxes are going up. The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax. Leawood Ks Property Tax Rate.

From www.hechtgroup.com

Hecht Group How To Pay Your Kansas Property Taxes Online Leawood Ks Property Tax Rate According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. Assessed value and estimated actual value of taxable property last ten fiscal years. The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. The 2023 budget includes a property tax. Leawood Ks Property Tax Rate.

From kansaspolicy.org

County property tax nearly triples rate of inflation and population Leawood Ks Property Tax Rate 95 property tax rates (per $1,000 of. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. Assessed value and estimated actual value of taxable property last ten. Leawood Ks Property Tax Rate.

From www.johnsoncountyhomereport.com

Leawood Estates homes for sale Leawood KS Leawood Ks Property Tax Rate According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. The 2024 budget includes a property tax rate — or mill levy rate — of. Leawood Ks Property Tax Rate.

From www.financestrategists.com

Find the Best Tax Preparation Services in Leawood, KS Leawood Ks Property Tax Rate 95 property tax rates (per $1,000 of. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. Property taxes are going up. The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. This is the same tax rate included in 2022’s. Leawood Ks Property Tax Rate.

From www.formsbank.com

Form A101 Estate Tax Return printable pdf download Leawood Ks Property Tax Rate The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. The state’s average effective property tax rate (annual. According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. Property tax rate comparison property taxes, also known as ad valorem taxes,. Leawood Ks Property Tax Rate.

From money.com

Leawood, KS rated in Best Places to Live in US by Money Money Leawood Ks Property Tax Rate The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. Property taxes are going up. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. The. Leawood Ks Property Tax Rate.

From marshaalanexo.blob.core.windows.net

Property Tax Rate Johnson County Ks Leawood Ks Property Tax Rate While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed. Leawood Ks Property Tax Rate.

From yourkansascityhome.com

Leawood, KS Homes for Sale 200,000 300,000 Listing Report Kristi Leawood Ks Property Tax Rate This is the same tax rate included in 2022’s budget, which the city intends. The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. The state’s average effective property tax. Leawood Ks Property Tax Rate.

From kansaspolicy.org

Local government hiked property tax 3X inflation in 2019 Kansas Leawood Ks Property Tax Rate While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. The state’s average effective property tax rate (annual. Property taxes are going up. This is the same tax rate included in 2022’s budget, which the city intends. Property tax rate comparison property taxes, also known as ad valorem taxes, are. Leawood Ks Property Tax Rate.

From kansaspolicy.org

5 things you need to know about property taxes in Kansas Kansas Leawood Ks Property Tax Rate 95 property tax rates (per $1,000 of. The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. The state’s average effective property tax rate (annual. This is the same tax rate included in 2022’s budget, which the city intends. Property taxes are going up. According to the 2021 johnson county property tax listing,. Leawood Ks Property Tax Rate.

From bariqviviana.pages.dev

2024 Property Tax Rates Esta Olenka Leawood Ks Property Tax Rate According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. This is the same tax rate included in 2022’s budget, which the city intends. Assessed value and estimated actual value of taxable property last ten fiscal years. Property tax rate comparison property taxes, also known as ad. Leawood Ks Property Tax Rate.

From www.kansascity.com

Leawood’s average apartment rental rate gets noticed Kansas City Star Leawood Ks Property Tax Rate 95 property tax rates (per $1,000 of. Property taxes are going up. Assessed value and estimated actual value of taxable property last ten fiscal years. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. According to the 2021 johnson county property tax listing, the average home in. Leawood Ks Property Tax Rate.

From sellhousefast.com

Sell Your House Fast in Leawood, KS Leawood Ks Property Tax Rate Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the assessed value real property, residential or. The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. 95 property tax rates (per $1,000 of. The 2023 budget includes a property tax rate — or mill levy rate —. Leawood Ks Property Tax Rate.

From kansaspolicy.org

Kansas has some of the nation’s highest property tax rates Kansas Leawood Ks Property Tax Rate According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. The state’s average effective property tax rate (annual. This is the same tax rate included in 2022’s budget, which the city intends. The 2024 budget includes a property tax rate — or mill levy rate — of. Leawood Ks Property Tax Rate.

From www.kansascommerce.gov

Property Tax Leawood Ks Property Tax Rate While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. 95 property tax rates (per $1,000 of. According to the 2021 johnson county property tax listing, the average home in leawood has a market value (appraised value) of $608,253, as. Assessed value and estimated actual value of taxable property last. Leawood Ks Property Tax Rate.

From kansaspolicy.org

County property tax nearly triples rate of inflation and population Leawood Ks Property Tax Rate The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. The state’s average effective property tax rate (annual. The 2023 budget includes a property tax rate — or mill levy rate — of 24.076 mills. 95 property tax rates (per $1,000 of. Property tax rate comparison property taxes, also known as ad valorem. Leawood Ks Property Tax Rate.

From infotracer.com

Kansas Property Records Search Owners, Title, Tax and Deeds InfoTracer Leawood Ks Property Tax Rate The 2024 budget includes a property tax rate — or mill levy rate — of 23.5 mills. While the typical homeowner in kansas pays just $2,445 annually in real estate taxes, property tax rates are fairly high. 95 property tax rates (per $1,000 of. Property tax rate comparison property taxes, also known as ad valorem taxes, are levied on the. Leawood Ks Property Tax Rate.